Posts Tagged “downsizing”

When you are retired and have less income to meet emergencies, take vacations, or handle a big-ticket repair, keep in mind that you have a ready source of cash at hand: your house. Your home is likely the largest financial asset you have. You can put your home equity to work for you. You may…

If you have decided to downsize into a smaller place, you’ve already made the difficult decision to sell your home. The next set of difficult decisions involves what to take with you. In your new home, you won’t have the room for everything you own. Also, you have made the decision to downsize your living…

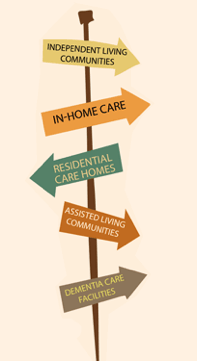

The idea of aging place is appealing to many seniors. Many want to stay in their home as long as possible. Their home is comfortable and they are happy there. It seems like the easy choice. But in reality, it’s one of life’s most difficult decisions. The options are “age in place” remaining in the…

The reality is, as we move thru the different stages of life our housing needs change. I meet with many retirees who are struggling with coming to terms with making a change. They know it is inevitable, they will have to make a move but is always easier to deal with it when it is…